How to Trade Crypto on Bitget

How to Trade Spot on Bitget (Web)

Bitget Spot Trading is the destination for anyone investing in and/or holding cryptocurrencies. With over 500 tokens, Bitget Spot Trading opens the door to the whole crypto universe. There are also exclusive, smart tools available for Bitget Spot Trading to help investors make better decisions and attain success, including:

- Limit Order/Trigger Order/other conditional orders

- Bitget Spot Grid Trading: Your personal bot to help you through sideways markets.

- Bitget Spot Martingale: The better, crypto-fitted version of dollar-averaging

- Bitget Spot CTA: The automated, algorithm-based tool that helps place timely and risk-controlled orders.

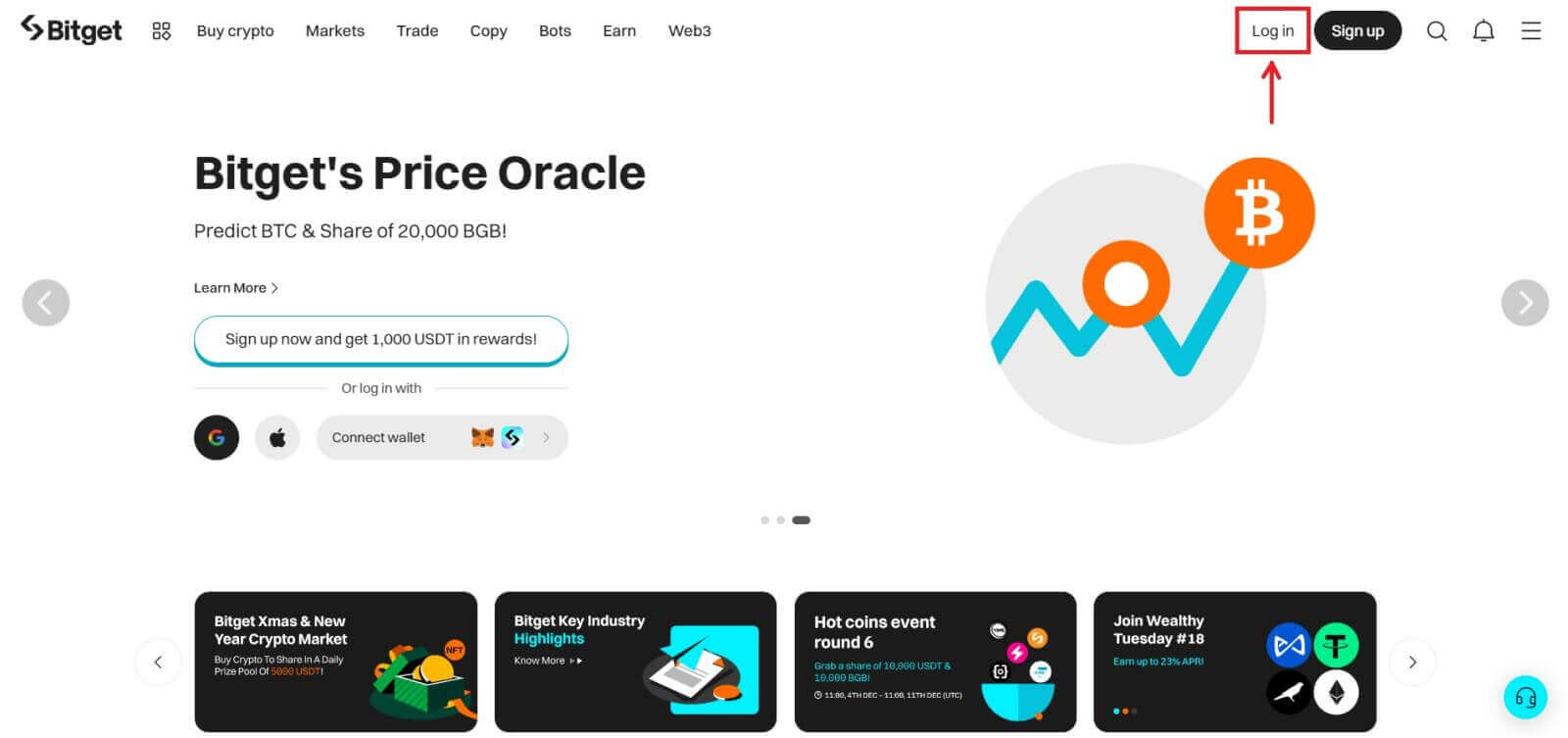

1. Visit the Bitget website, click on [Log in] at the top right of the page and log into your Bitget account.

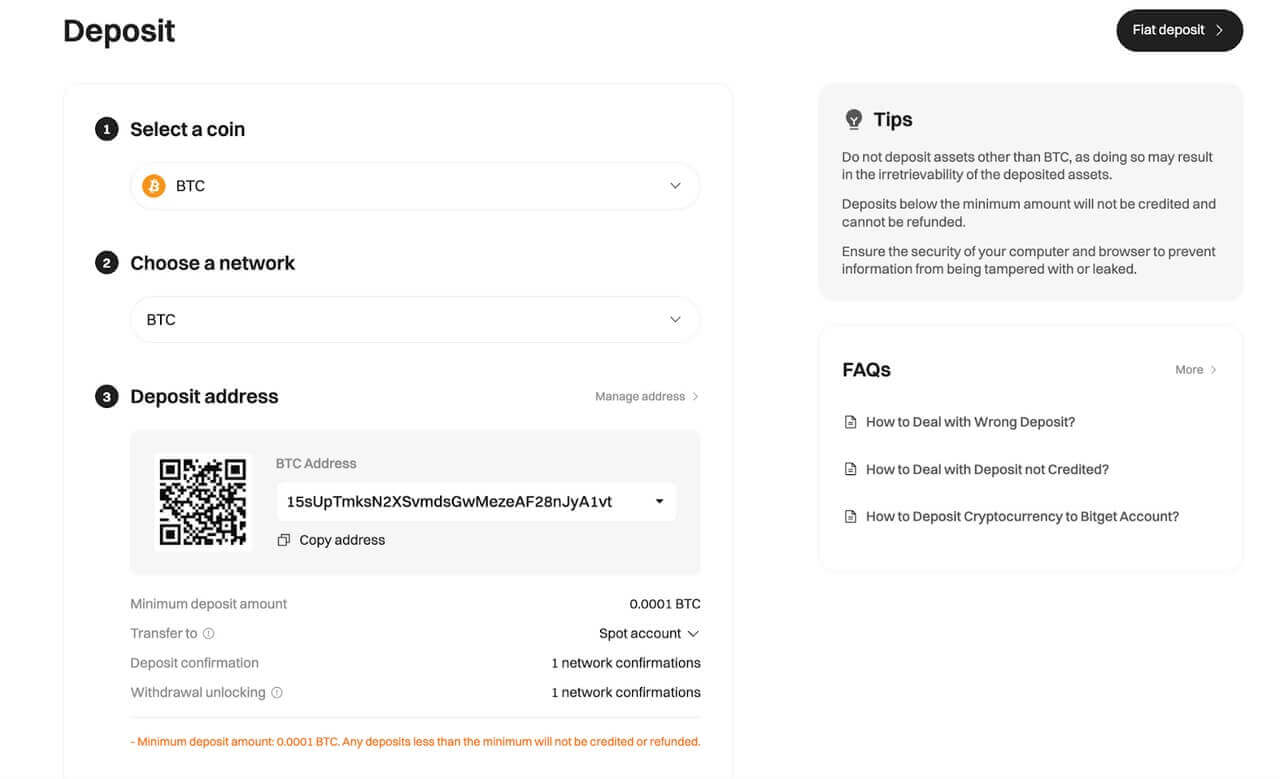

2. Deposit your asset into your Bitget spot account or buy USDT/USDC/BTC/ETH. Bitget offers several methods for purchasing these coins: P2P, bank transfer, and credit/debit cards.

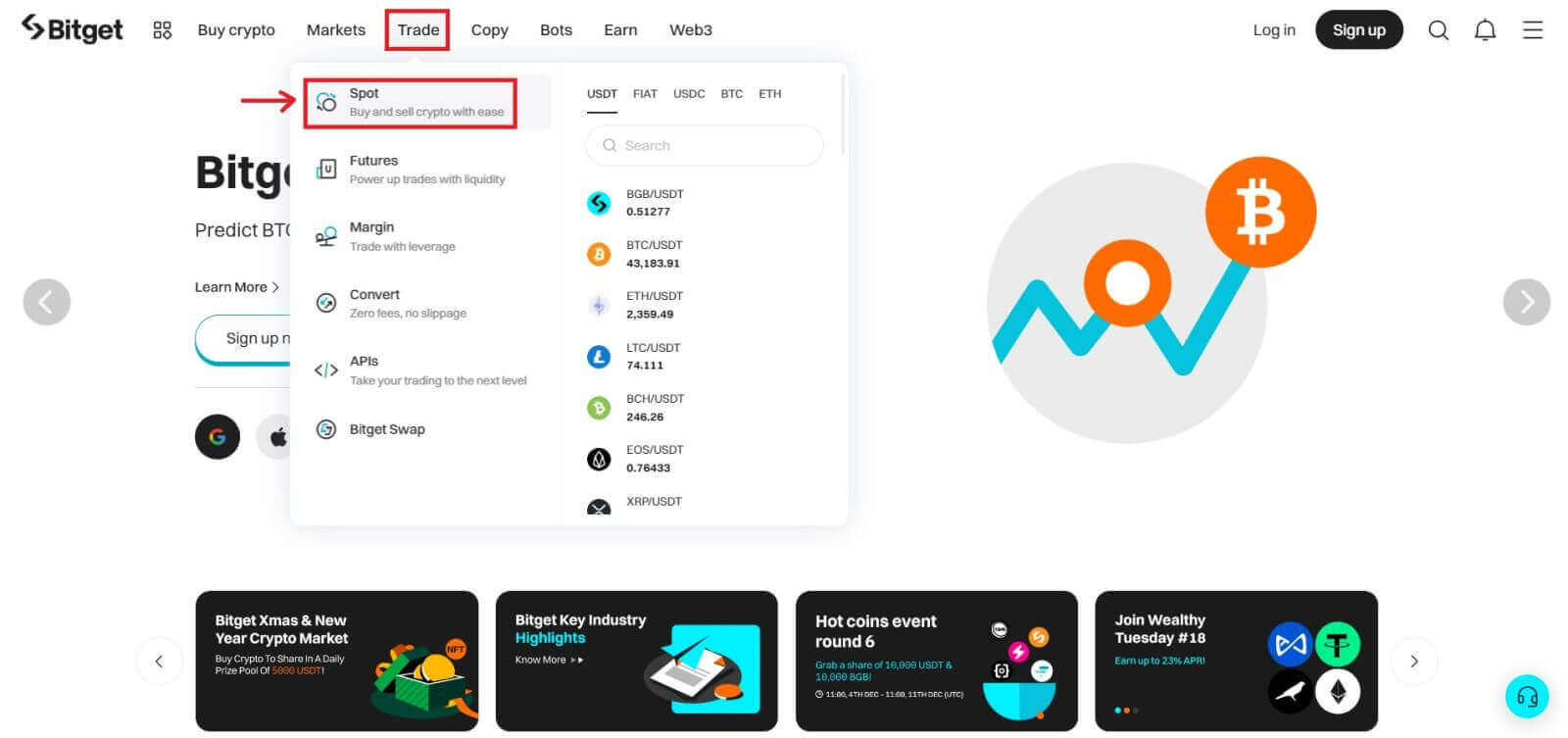

3. Navigate to [Spot] in the [Trade] tab to view the available pairs.

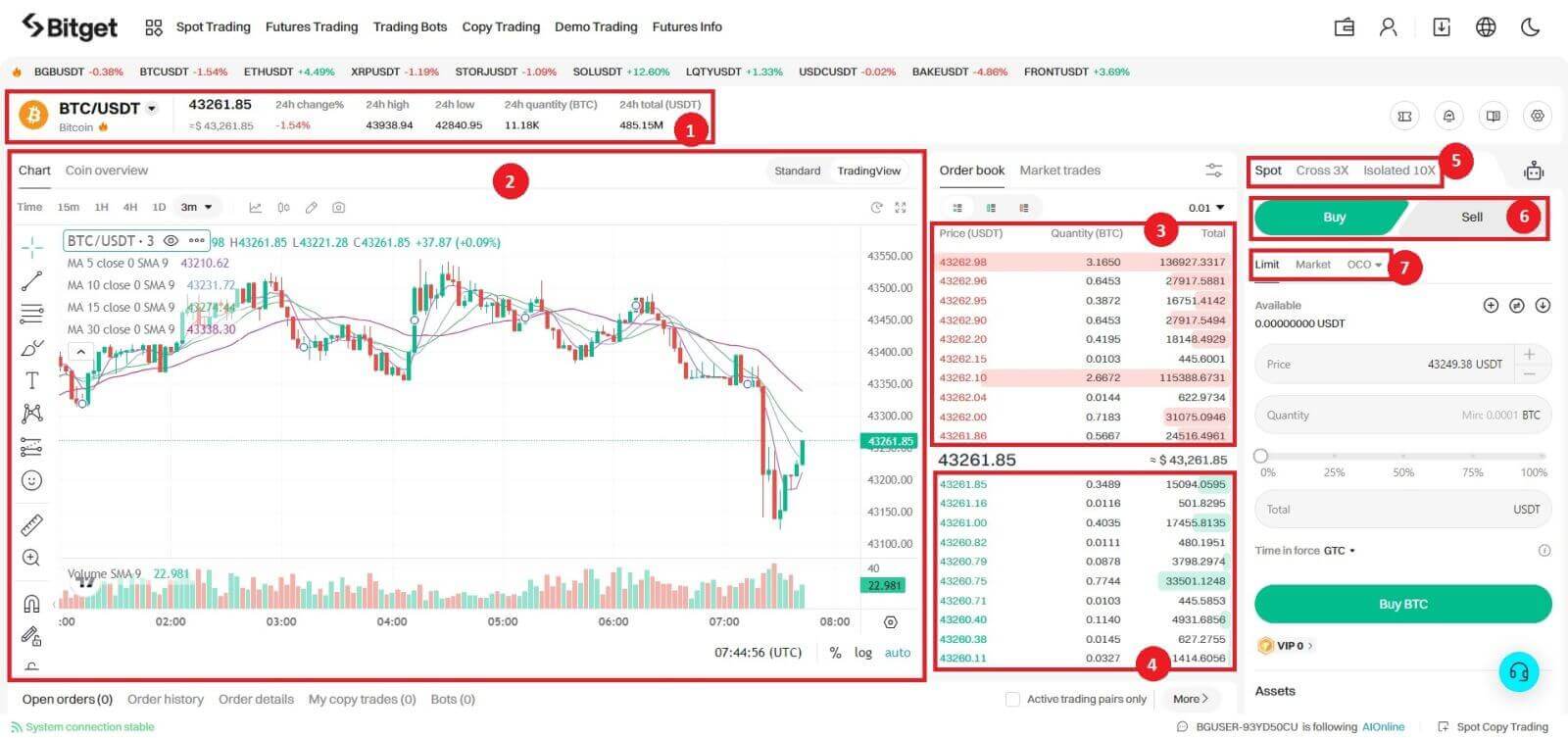

4. You will now find yourself on the trading page interface.

1. Trading volume of trading pair in 24 hours

2. Candlestick chart and Market Depth

3. Sell order book

4. Buy order book

5. Trading Type: Spot/Cross 3X/Isolated 10X

6. Buy/Sell Cryptocurrency

7. Type of order: Limit/Market/OCO(One-Cancels-the-Other)

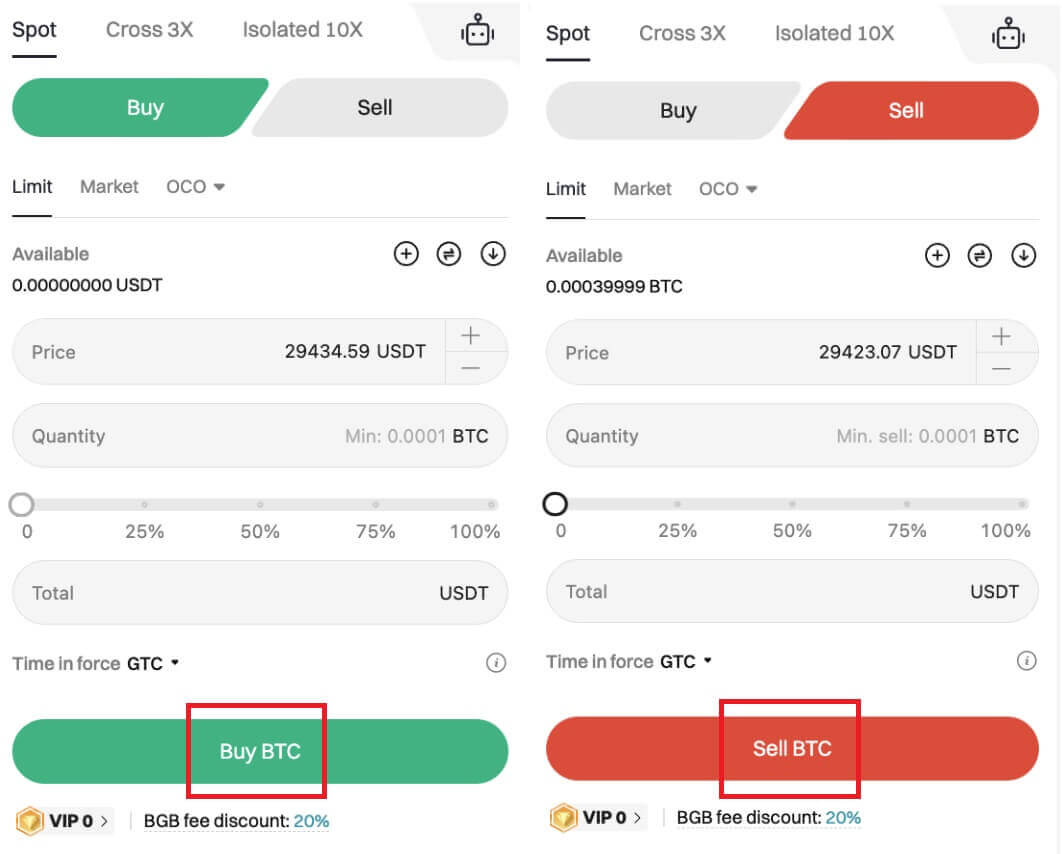

5. Choose your preferred pair and don’t forget to fill in the number for market order and other conditional orders. Once you’re done, click Buy/Sell.

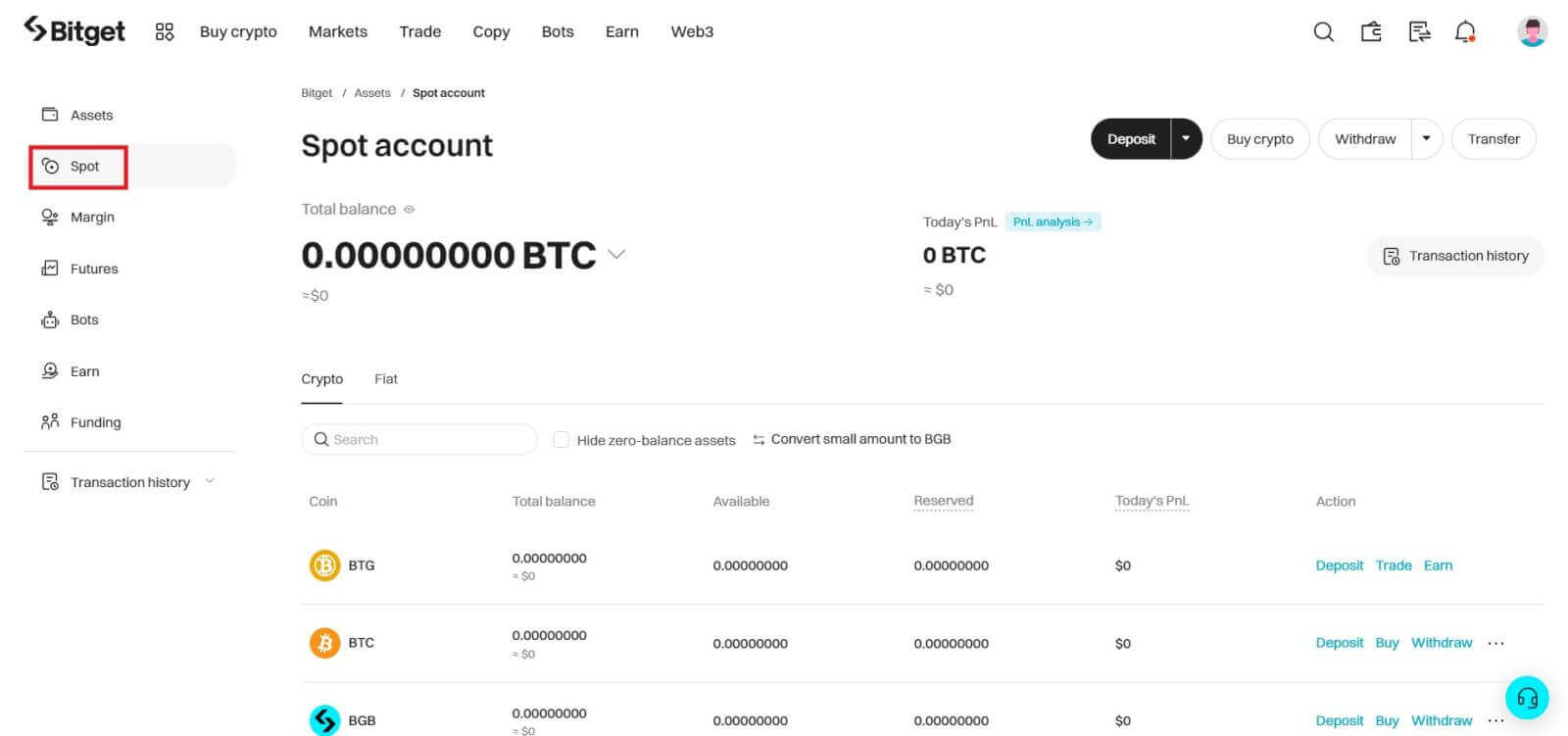

6. To check your assets, go to [Asset] → [Spot].

How to Trade Spot on Bitget (App)

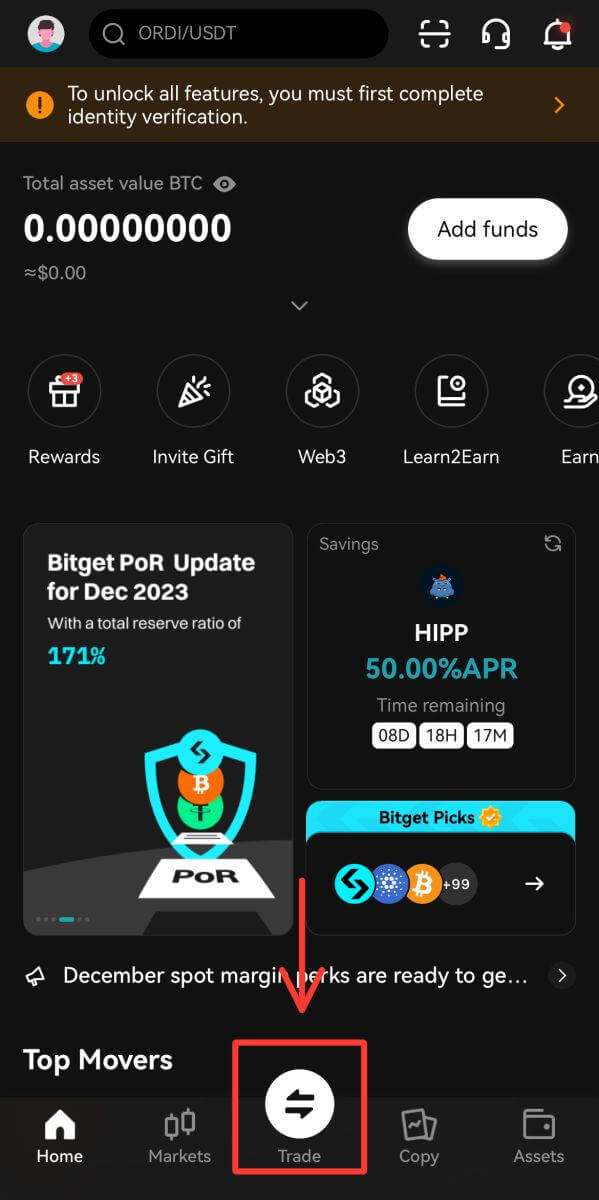

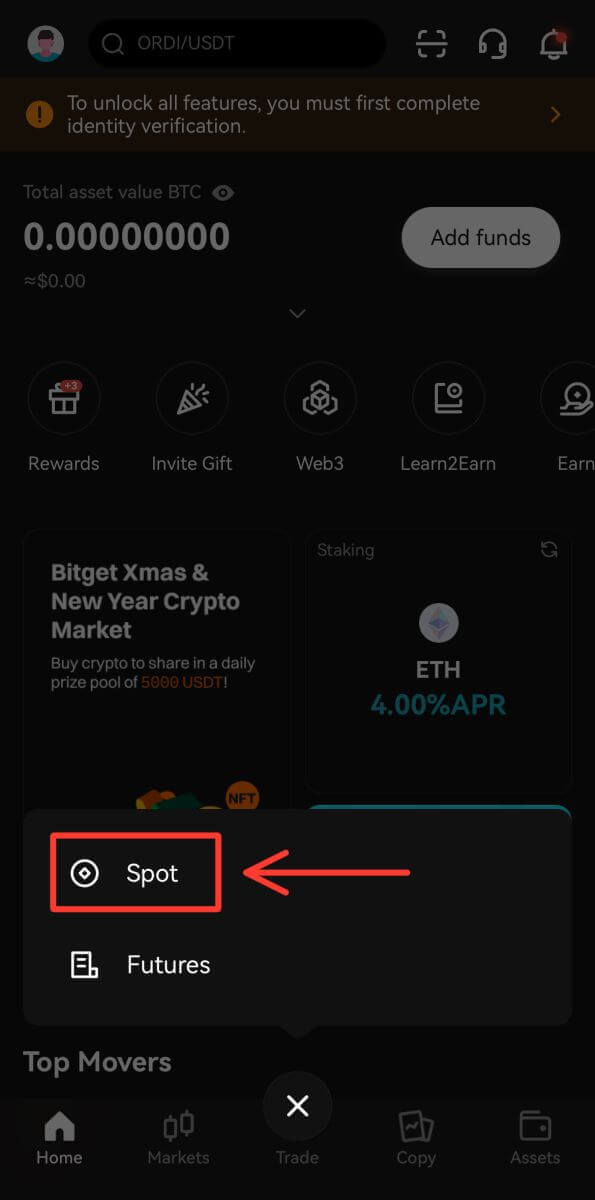

1. Log in to the Bitget App, and click on [Trade] → [Spot] to go to the spot trading page.

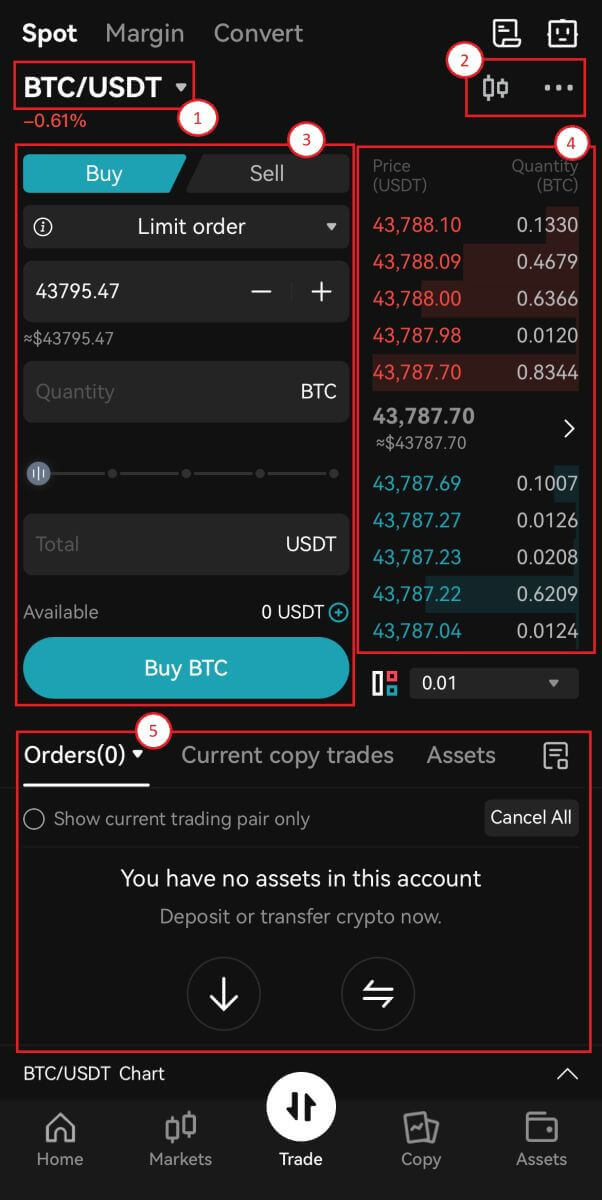

2. Here is the trading page interface.

1. Market and Trading pairs.

2. Real-time market candlestick chart, supported trading pairs of the cryptocurrency, “Buy Crypto” section.

3. Buy/Sell Cryptocurrency.

4. Sell/Buy order book.

5. Open orders.

Take-Profit and Stop-Loss

What is a take-profit/ stop-loss?

A frequent contract trading strategy known as "taking profit" involves users believing that the price has reached an important point, in which they believe it a wise decision to realize some profit. By taking profit, the trade position is being reduced and as a result unrealized profits have now been turned into real profit, ready to be cashed out.

Stop loss is a common contract trading operation in which users believe that the price has reached a level where the trade can be cut for a reasonable loss to avoid doing irreparable damage to their portfolio. Using a stop loss is a way to deal with risk.

Bitget currently provides a TP/SL order: users can set the TP/SL price in advance. When the latest market transaction price reaches the TP/SL price you set, it will close the position at the number of contracts you set for this position at the optimal transaction price.

How to determine to stop loss and take profit levels

Deciding on taking profits and placing stop losses is one of the most difficult things to do when trading and can be done in countless ways. It often depends heavily on what strategy you are utilizing. To help you get on your way, here are three options you can consider looking into to help decide where your levels are going to be.

Price structure

In technical analysis, the structure of price forms the basis of all tools. The structure on the chart represents an area where people valued the price as high as resistance and a place where traders valued the price as low as support. At these levels, there is a high likelihood of increased trading activity, which can provide great places for prices to take a breather and then either continue or reverse. This is why many traders consider them checkpoints, and therefore those who use this method generally place profits just above support and stop losses just above resistance.

Volume

Volume is a great momentum indicator. However, it is a bit less exact, and more practice is required to read into the volume, but it is a great method to see whether a trending move might come to an end soon or when you are wrong on the direction of the trade. If the price goes up on a continuous increase in volume, it indicates a strong trend, whereas if the volume depletes with every thrust up, it might be time to take some profits. If you are in a long trade and price moves up on slow volume and price starts to retrace on an increase in volume, it might indicate weakness and might mean a reversal instead.

Percentages

Another method is to think in percentages, where traders have a fixed percentage in mind that they wish to use to place their stop loss and take profit levels. An example could be when a trader closes their position whenever the price has moved 2% in their favor and 1% whenever the price has moved against them.

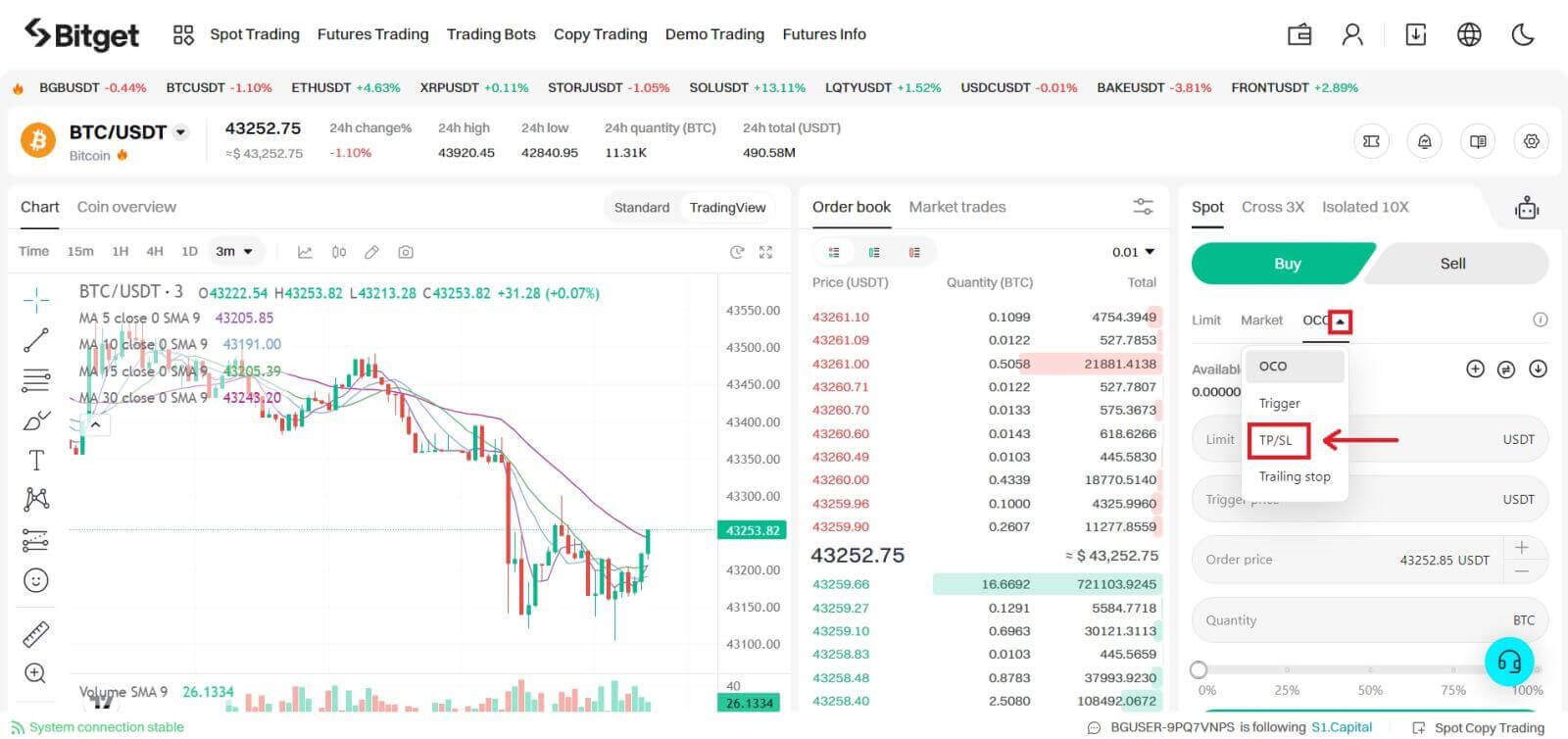

Where can I find the stop loss and take profit levels

Go to the trading page interface, find the [TP/SL] from the dropbox.

Frequently Asked Questions (FAQ)

What are the 3 types of order?

Market Order

Market Order - as the name implies, orders are executed immediately at the current market price. Please note that in more volatile markets, for example cryptocurrencies, the system will match your order to the best price possible, which can be different from the price at execution.

Limit Order

Also set to be completed as quickly as possible but the Limit Order will be filled at a price closest to the price you are willing to sell/buy, and can be combined with other conditions to refine your trading decision.

Let’s take an example: You want to buy BGB right now and its current value is 0.1622 USDT. After you enter the total amount of USDT you use to buy BGB, the order will be filled instantly at the best price. That is a Market Order.

If you want to buy BGB at a better price, click on the drop-down button and choose Limit Order, and enter the price to initiate this trade, for instance 0.1615 USDT. This order will be saved into the order book, ready to be completed at the level nearest to 0.1615.

Trigger Order

Next, we have the Trigger Order, which is automated as soon as the price hits a particular level. Once the market price reaches, let’s say, 0.1622 USDT, the Market Order will be placed and completed instantaneously. The Limit Order will be placed to match the price set by the trader, maybe not the best but surely the closest to his/her preference.

Transaction fees for both Maker and Taker of Bitget spot markets stand at 0.1%, which comes with a 20% discount if traders pay these fees with BGB. More information here.

What is an OCO order?

An OCO order is essentially a one-cancels-the-other order. Users can place two orders at the same time, i.e., one limit order and one stop limit order (an order placed when a condition is triggered). If one order executes (fully or partially), then the other order is automatically canceled.

Note: If you cancel one order manually, the other order will be automatically canceled.

Limit order: When the price reaches the specified value, the order is fully or partially executed.

Stop limit order: When a specific condition is triggered, the order is placed based on a designated price and amount.

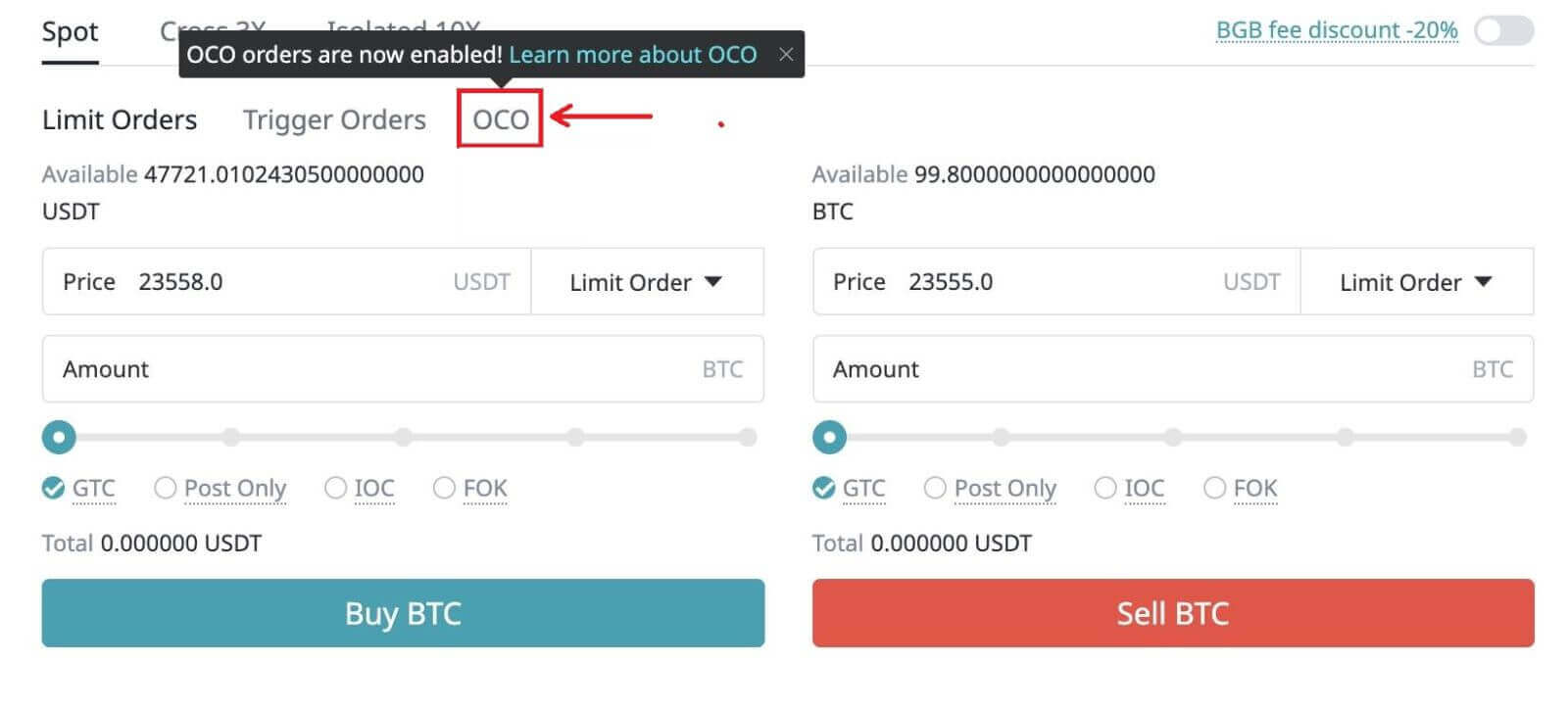

How to place an OCO order

Navigate to the Spot Exchange page, click OCO, and then create an OCO buy order or sell order.

Limit price: When the price reaches the specified value, the order is fully or partially executed.

Trigger price: This refers to the trigger condition of a stop limit order. When the price is triggered, the stop limit order will be placed.

When placing OCO orders, the price of the limit order should be set below the current price, and the trigger price should be set above the current price. Note: the price of a stop limit order can be set above or below the trigger price. To summarize: Limit price

For example:

The current price is 10,000 USDT. A user sets the limit price at 9,000 USDT, the trigger price at 10,500 USDT, and a buying price of 10,500 USDT. After placing the OCO order, the price rises to 10,500 USDT. As a result, the system will cancel the limit order based on a price of 9,000 USDT, and place a buy order based on a price of 10,500 USDT. If the price drops to 9,000 USDT after placing the OCO order, the limit order will be partially or fully executed and the stop limit order will be canceled.

When placing an OCO sell order, the price of the limit order should be set above the current price, and the trigger price should be set below the current price. Note: the price of a stop limit order can be set above or below the trigger price in this scenario. In conclusion: Limit price current price trigger price.

Use case

A trader believes the price of BTC will continue to rise and wants to place an order, but they want to buy in at a lower price. If this isn’t possible, they can either wait for the price to fall, or place an OCO order and set a trigger price.

For example: The current price of BTC is 10,000 USDT, but the trader wants to buy it at 9,000 USDT. If the price fails to fall to 9,000 USDT, the trader may be willing to buy at a price of 10,500 USDT while the price keeps rising. As a result, the trader can set the following:

Limit price: 9,000 USDT

Trigger price: 10,500 USDT

Open price: 10,500 USDT

Quantity: 1

After the OCO order is placed, if the price drops to 9,000 USDT, the limit order based on a price of 9,000 USDT will be fully or partially executed and the stop limit order, based on a price of 10,500, will be canceled. If the price rises to 10,500 USDT, the limit order based on a price of 9,000 USDT will be canceled and a buying order of 1 BTC, based on a price of 10,500 USDT, will be executed.