How to do Futures Trading on Bitget

Futures trading on Bitget offers a platform for users to speculate on the future price movements of various cryptocurrencies. This guide aims to provide a step-by-step process to start futures trading effectively on Bitget.

What are futures contracts?

A futures contract is simply an agreement between two parties to transact a particular asset at a specific future time and a negotiated price. Each futures contract must contain the following elements:

- The underlying asset (often referred to as the underlying): This is the "source" of value. A futures contract can be written on commodities, stocks, interest rates, and even digital currencies.

- The expiration date.

- The settlement method, i.e. should sellers deliver the actual underlying asset when futures expire, or are they being quoted the associated cash positions?

Why choose Bitget for futures trading?

Industry-leading asset security

- Bitget provides asset protection with Proof of Reserves, a Protection fund, and third-party asset custody services.

Seamless trading experience

- Bitget’s perpetual and delivery futures provide users with sufficient liquidity to help users explore futures trading in depth.

Mature matching engine

- Bitget ensures a smooth trading experience for users through advanced matching technology.

24/7 customer service support

- Bitget guarantees 24/7 customer service support and will solve users’ problems promptly and efficiently.

How do they work?

Futures work as a speculation on future prices of the underlying. Buyers can either bet on a price increase and open a long position or expec t price levels to decline and short the contracts. Indeed, the outstanding positions in futures markets reflect collective confidence in the underlying industry. Portfolio managers usually turn to futures to effectively and economically reduce their exposure to other assets

How to trade Bitcoin futures on Bitget

Bitcoin futures contract is a derivative product similar to traditional futures contracts. It is an agreement between two parties to buy or sell a specific amount of Bitcoin at a specific time in the future.Each future transaction will include both long (agree to purchase) and short position (agree to sell). If the marked price on the contract is above the entry price at the expiration date, the buyer will profit and the short position will suffer loss, and vice versa. Your profit or loss is calculated as: (M ark Price - Entry Price) x Amount x Leverage Ratio. You earn or lose money proportional to your leverage ratio and the difference between your entry price and the underlying’s mark price.

If you want to start trading Bitcoin futures on Bitget, you just need to set up an account and get yourself some funds. Here’s the step-by-step guide to start trading Bitcoin futures contracts:

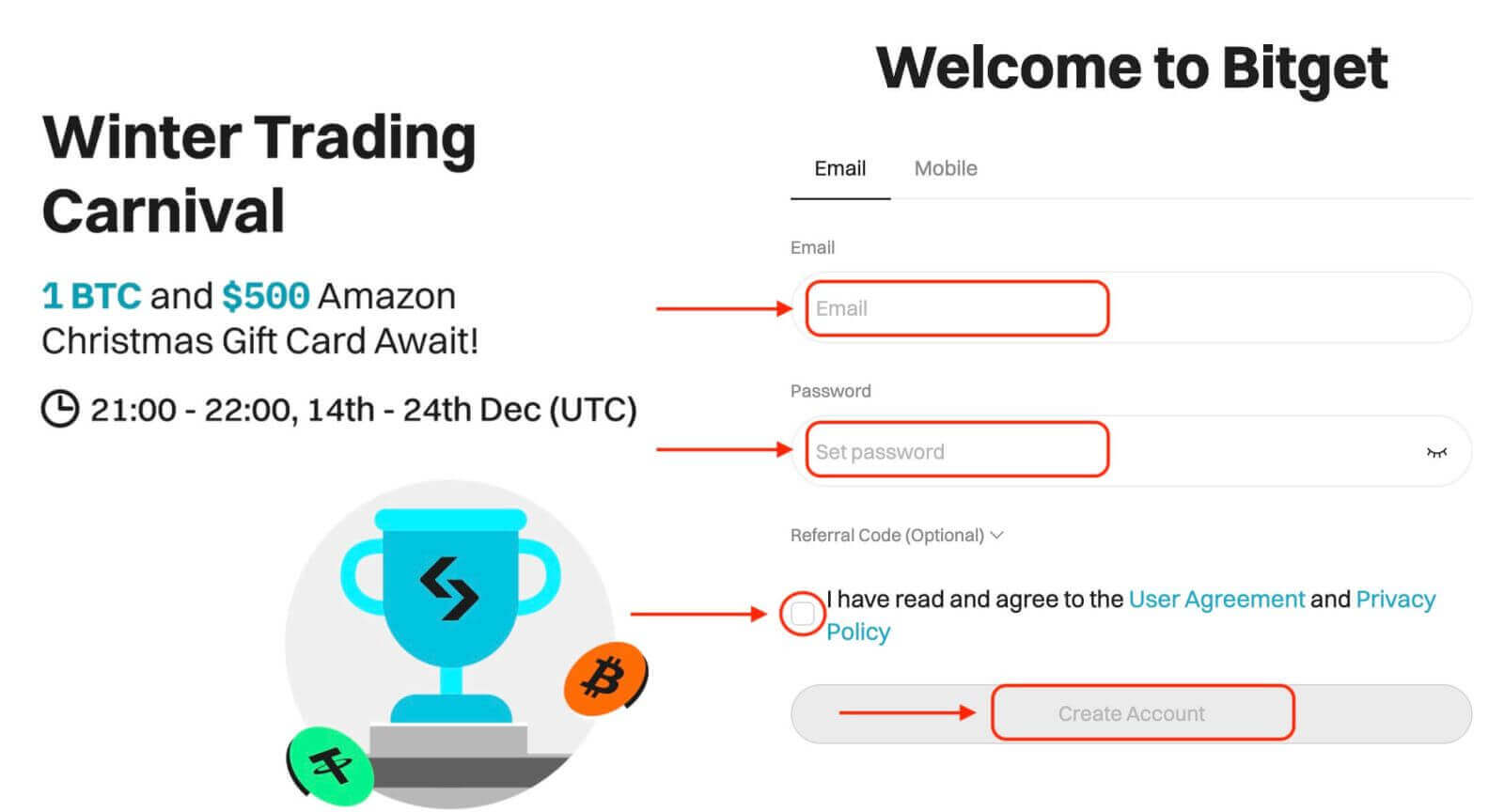

1. Create an account on Bitget and complete the identity verification. If you already have an account and complete the identity verification, you can deposit funds into your future account.

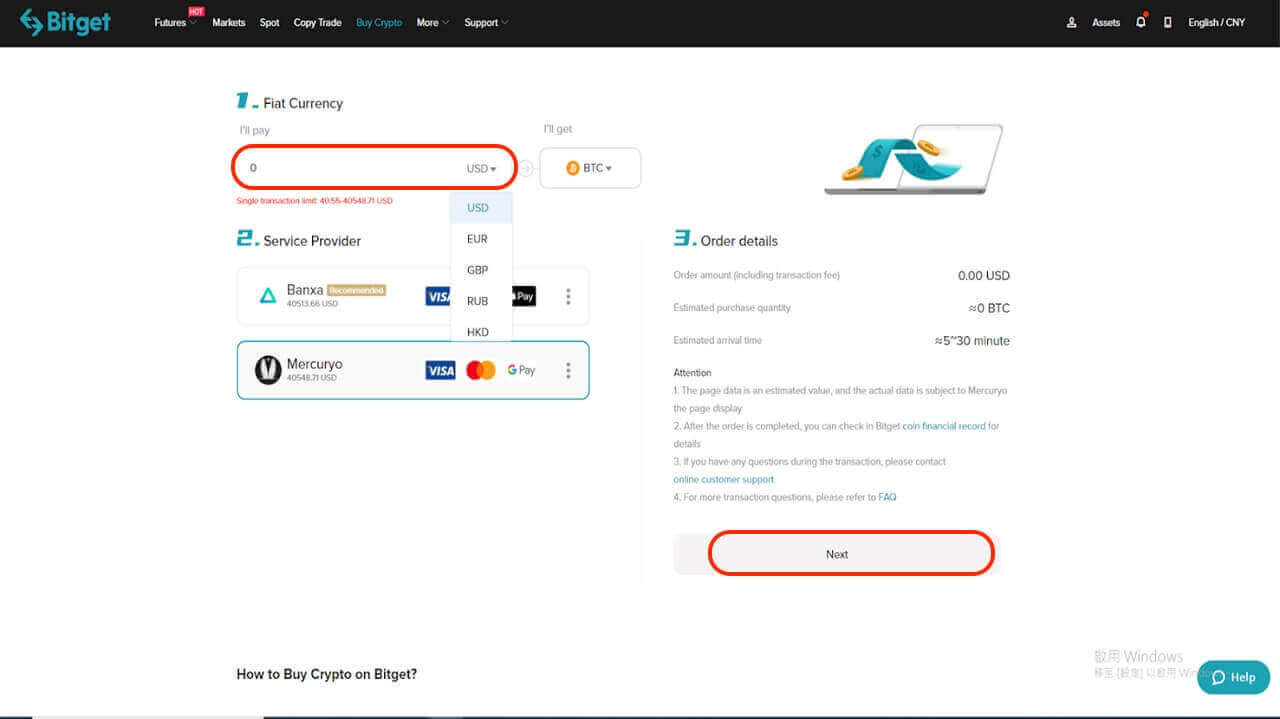

2. Purchase some BTC, Tether (USDT), or other supported cryptocurrencies for futures trading. The easiest way to do this is to purchase them with your debit or credit card.

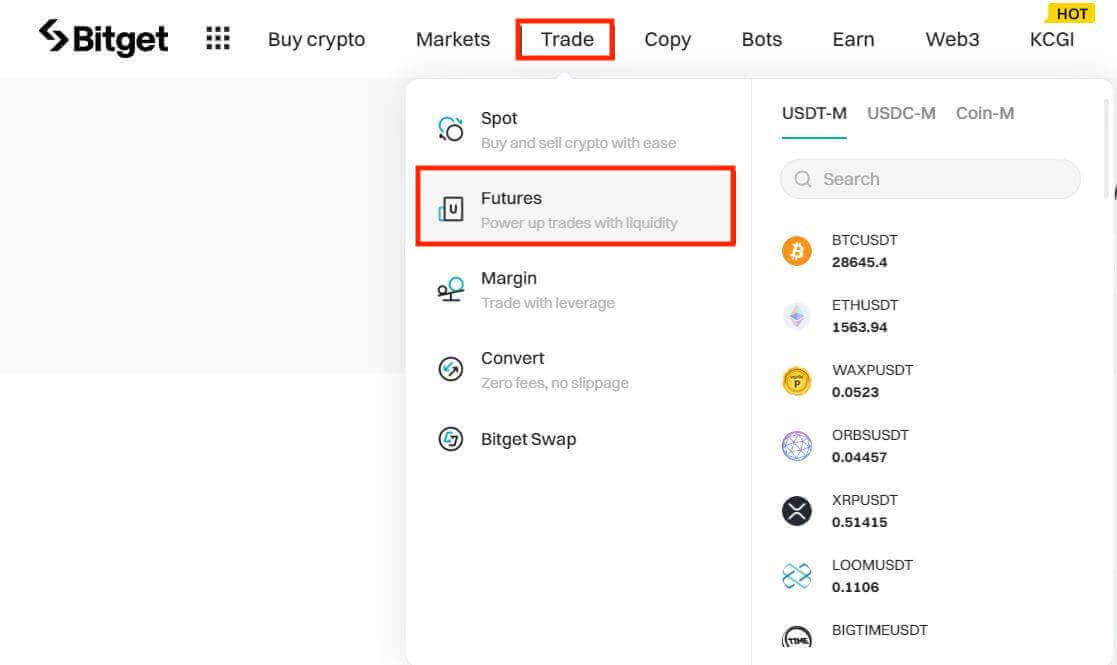

3. Navigate to the Bitcoin futures overview and select the type of contract you want to purchase. Select any of the futures products under "Trade" - "Futures" in the upper navigation bar.

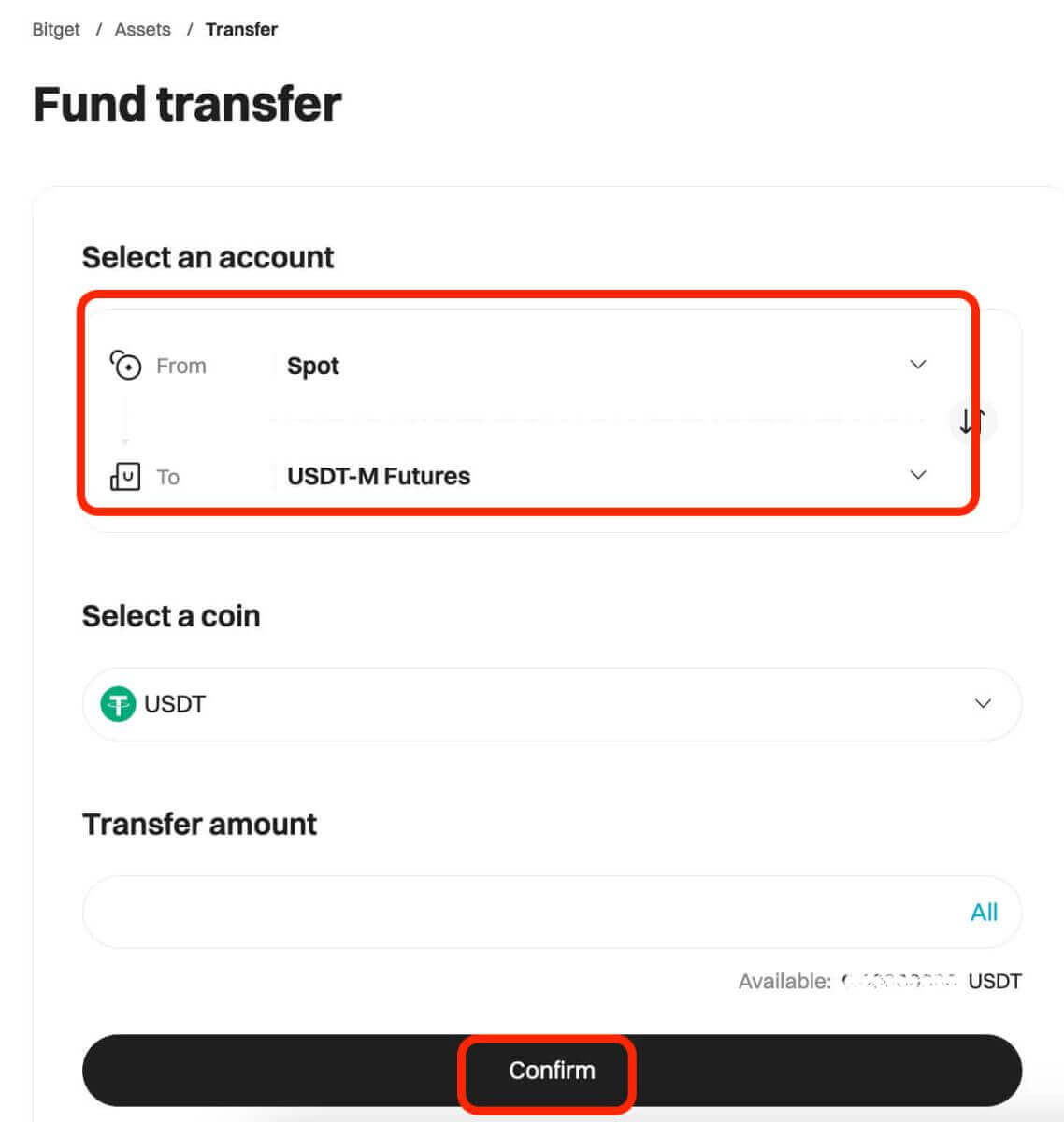

4. Before opening a position, if there are no assets in your Futures account, you can click on the "Transfer" function to transfer crypto from other accounts to Futures account. There is no fee for internal transfers.

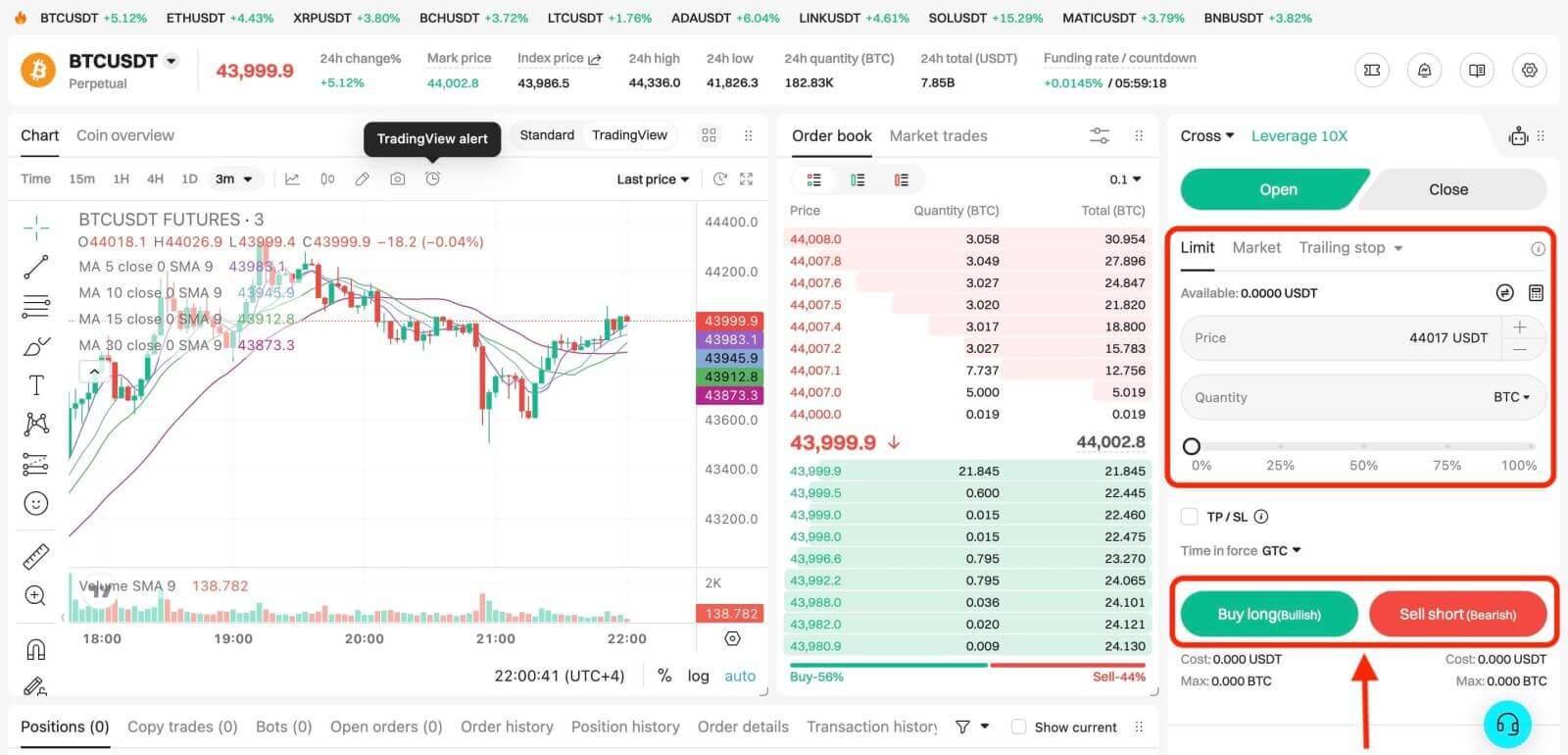

5. After selecting the trading pair, margin mode, order type, and leverage, enter the price and quantity, and select the direction to place an order.